Shaping the Future: Your Apprenticeship at Gehrke Econ

Immerse yourself in our world of opportunities and discover what makes us a unique employer. Here, we present our various apprenticeship programs, study opportunities, and internship options.

In the following video, our trainees share five compelling reasons to choose training at Gehrke Econ.

Our apprenticeship programs

“Ausbildung zum Steuerfachangestellten (m/f/d)”

The focus areas in the profession of a tax clerk include handling financial accounting, preparing tax returns, income-surplus calculations, and annual financial statements, as well as providing advisory support to our clients.

Requirements

- High school diploma (Abitur) or good secondary school diploma with subsequent business school education

- Interest in economic and tax-related tasks

- Enjoy working with people and willingness to work in a team

- Commitment and willingness to perform

Training Duration

3 years (with the possibility of shortening for good performance)

Compensation

1st year: 1,200 € / 2nd year: 1,300 € / 3rd year: 1,400 €

Not sure if the profession of a tax clerk (m/f/d) is the right fit? Take the suitability test for tax clerks provided by the Federal Chamber of Tax Advisors here.

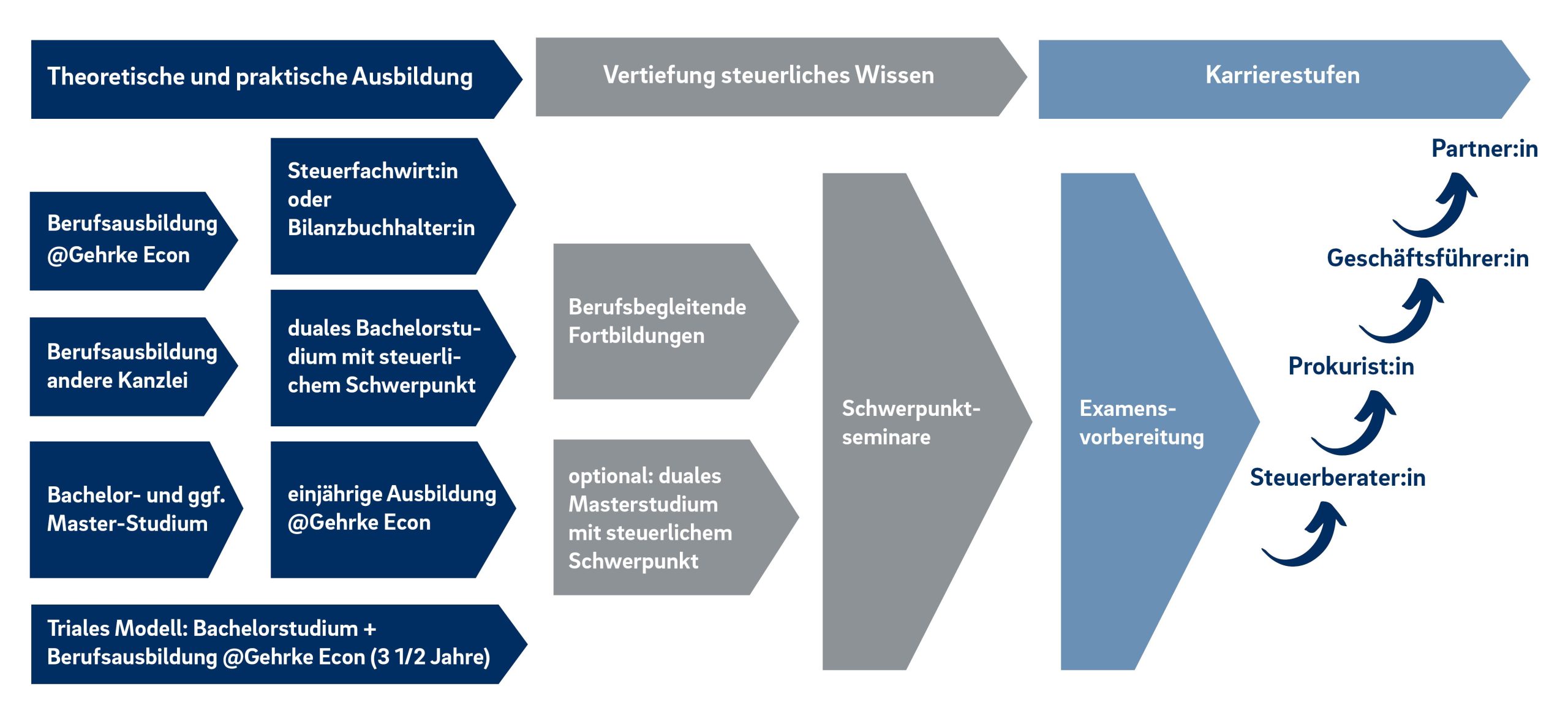

Our career path offers diverse routes and goals. No matter where you start or what professional goal you choose, we support you on your journey.

“Ausbildung zur Kauffrau für Büromanagement (m/f/d)”

Our office management assistants gain comprehensive insight into the training areas of secretarial work, marketing, business consulting, payroll accounting, and reception.

We offer the following elective qualifications:

Order Management and Coordination, Commercial Control and Monitoring, Commercial Processes, Payroll Accounting, Assistance and Secretarial Tasks, Marketing and Sales.

Requirements

- Good secondary school diploma

- Interest in organizational tasks

- Enjoy working with people and willingness to work in a team

- Commitment and willingness to perform

Training Duration

3 years (with the possibility of shortening for good performance)

Compensation

1st year: 1,000 € / 2nd year: 1,100 € / 3rd year: 1,200 €

“Ausbildung zum Fachinformatiker für Systemintegration (m/f/d)”

Tasks in the profession of an IT specialist for system integration include identifying and resolving issues in the server and client infrastructure in the hardware and software areas, advising, supporting, and training users, and planning, installing, and configuring complex information and telecommunications systems.

Requirements

- Intermediate secondary school diploma or higher education entrance qualification (ideally with a focus on IT or computer science)

- Interest in IT topics, hardware and software, as well as technical and economic contexts

- Technical and analytical thinking skills and a careful working approach

- Initiative, flexibility, and willingness to take on responsibility

- Team spirit, fairness, and respect in dealing with others

- Willingness to learn, commitment, teamwork, and a strong work ethic

Training Duration

3 years (with the possibility of shortening for good performance)

Compensation

1st year: 1,000 € / 2nd year: 1,100 € / 3rd year: 1,200 €

Our Study Programs

Dual Study Program (B.A. / LL.B.) Taxation

The dual study program combines theory and practice through quarterly alternation between the university and Gehrke Econ. Your placement in different teams varies based on the chosen focus in the study program or the planned placement after graduation.

- Degree: Bachelor of Arts (B.A.) or Bachelor of Laws (LL.B.)

- Duration: 7 semesters

- Contribution to tuition fees: Covered partially by Gehrke Econ

- Additional compensation: Based on prior knowledge

Study Models

We cooperate with FHDW Hannover for the degree program “Business Administration Tax and Auditing (B.A.)” and with FOM for the degree program “Tax Law (LL.B.).”

° FHDW: Alternating three months of study at the university and three months of practical experience in the company

° FOM: Various time models are available, including evening and Saturday studies or daytime studies.

Requirements

- General or advanced technical college entrance qualification

- Interest in economic and tax-related tasks

- Enjoy working with people and in a team

- Completed training as a tax clerk (m/f/d)

Study Content

FHDW ° Business Administration with a Focus on Tax and Auditing

- Fundamental knowledge of business administration and various cross-disciplinary qualifications, complemented by the specialized content of the “Tax and Auditing” focus

- Understanding complex legal and fiscal conditions for structuring business processes

- Acquiring comprehensive knowledge of German tax law and its specifics

- Intensive engagement with accounting and financial reporting issues

- Possibility of admission to the “Tax Clerk” exam by the Lower Saxony Chamber of Tax Advisors after the 5th semester

FOM ° Tax Law

- Overview of important regulations in the Fiscal Code and Inheritance Tax

- Engagement with the legal and formal foundations of international tax law

- Understanding of transformation tax law and discussion of special issues in taxation

- General business administration knowledge from national and international contexts, including areas such as investment and finance, budgeting, and corporate planning

Practical Phases at Gehrke Econ

Tax Consulting

- Support in preparing financial accounting

- Assisting in the preparation of annual financial statements and income surplus calculations

- Assisting with corporate and individual tax returns

- Handling ongoing tax-related inquiries from our clients

Auditing

- Participation in the audit of annual and consolidated financial statements under the German Commercial Code (HGB)

- Assisting in the preparation of reports on accounting and valuation issues

Business Consulting

- Support in project work

- Participation in planning calculations, cost accounting, and reporting

- Assisting in the preparation of restructuring concepts

- Preparing presentations as part of market research

Trilateral Training Model ° Apprenticeship + Parallel Study Program

The trilateral training model combines training as a tax clerk (m/f/d) with a parallel part-time study program in tax law (LL.B.) or business administration with a focus on tax and auditing (B.A.). In this model, vocational training is completed after 2.5 years, and the part-time study program is completed one year later, after a total of seven semesters.

- Degree: Bachelor of Laws (LL.B.) in Tax Law or Bachelor of Arts (B.A.) in Business Administration with a Focus on Tax and Auditing + Training as a Tax Clerk (m/f/d)

- Duration: 7 semesters

- Contribution to tuition fees: Covered partially by Gehrke Econ

- Above-average training compensation for 2.5 years and then a prorated starting salary

Study Content

- Advising on tax-related issues

- Preparation of annual and interim financial statements in accordance with the German Commercial Code (HGB) and tax law

- Serving as a point of contact for tax audits and annual audits

- Analyzing and evaluating business performance indicators

- Handling corporate tax matters

- Analyzing business processes considering tax aspects

Internship

Student Internship, Mandatory Internship, Internship for Career Orientation

Explore the world of tax, business, legal consulting, or auditing with one of our diverse internship opportunities.

Your Benefits:

- Personal Development: Through the internship, you can improve your communication skills, teamwork, problem-solving abilities, and independence.

- Career Orientation: An internship at Gehrke Econ allows you to explore your interests and skills related to the consulting industry and consider whether a career in this field is right for you.

- Future Reference: A successful internship at Gehrke Econ can be a valuable reference for future applications and career opportunities.

You can find additional benefits of an internship as part of a study program here.

If you are interested, please apply proactively through our online application management system, indicating the desired position and timeframe.

In the following video, Elisabeth Lehmann reports on her internship day as part of the internship week at Gehrke Econ.

You can find our current job postings here.

The selection process for our apprenticeships for 2025 will start in autumn 2024.

Your contact